Property Taxes Part II - Islands Trust- 2014

Saturna Island Property Owners Association

Property Taxes 101: Part II

1

The

Islands

Trust

Mandate

The Province enacted the Islands Trust Act in 1974 with the objective to protect the

unique character and environment of the islands in the Salish Sea. The Act gives the

Islands Trust, a unique form of local government, the following powers and

responsibilities:

• Official community plans

• Zoning and rural land use bylaws

• Subdivision bylaws

• Development permits

• Regulation of soil removal and deposit

• Regulation of buildings

• Imposition of development cost charges to pay for parks and other services

A lesser-known aspect, established by the Islands Trust Act, is the Islands Trust Fund,

which acquires and holds land and interests in land for the protection of special areas

and features of the islands and waters of the Salish Sea for the “benefit of all British

Columbians”

The Trust Area covers 13 major islands and 450 smaller islands, 18,758 properties and

has a population of 25,5701.

Islands

Trust

Budget

and

Funding

The Islands Trust is primarily funded through property taxes levied in the Trust Area. A

small portion (3% of total funding) comes from a provincial grant that has steadily

declined from $545,000 in 1994 to $187,000 in 2013.

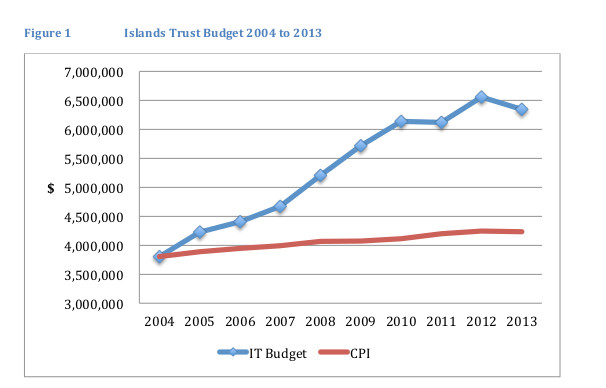

Between 2004 and 2013 the Islands Trust budget grew by 67%, from $3.8 million to

$6.4 million, which is a steep increase compared to the Consumer Price Index (CPI or

inflation) of 11%. As shown in Figure 1, in the past year the rapid growth in costs has

been reversed and between 2012 and 2013 the budget even decreased somewhat, but

the gap between CPI and actual costs still stands at $2.1 million.

1

2011

census

aturna Island Property Owners Association

Property Taxes 101: Part II

2

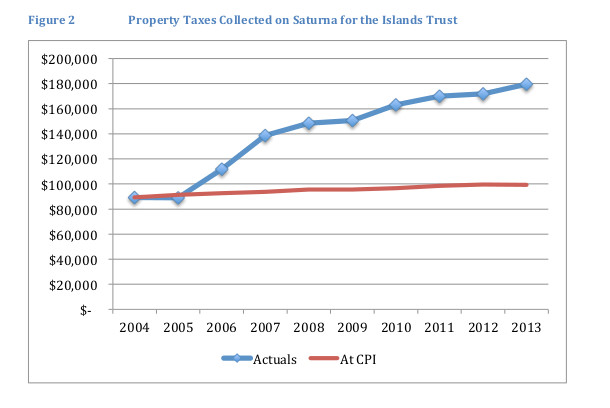

Over the same period, 2004-2013, property taxes collected on Saturna for the Islands

Trust doubled (Figure 2), which means that the proportion paid by Saturna has

increased. In 2013, Saturna property owners paid $180,000 to the Islands Trust, the

equivalent of 2.8% of the total Island’s Trust budget, but we only represent 1.3% of

total population in the trust area.

aturna Island Property Owners Association

Property Taxes 101: Part II

3

So

why

the

vast

increase

in

Islands

Trust

budget?

In general, CPI is a broad measure of expected cost increases for public services.

Where the quality of services is improved or where due to population growth more

services have to be provided, increases larger than inflation could be expected. So let

us look at what potentially could have driven up the budget for the Islands Trust:

• Substantial growth in population and the number of properties resulting in an

increased volume of requests for changes to zoning and sub-divisions.

• Developing new Official Community Plans.

• Provincially directed programs.

So, what actually happened?

Over the past decade there has been virtually no change in population. From the 2006

to 2011 the Trust area population grew by 0.8%. No data is available on the number of

properties on each island, but with slowing population growth it is reasonable to expect

that the demand for re-zoning and sub-divisions are not growing faster than population,

that is less than 0.15% per year.

Developing new Official Community Plans (OCP) is a large undertaking and does chew

up staff resources. Over the past decade no new OCPs have been developed.

In the past ten years there has been two (2) provincially directed programs: climate

change and riparian area regulations, both of which are substantially complete. These

required revisions to either zoning or OCP’s.

It is clear that the large increase in the Islands Trust budget is neither growth nor

service driven. So what increased?

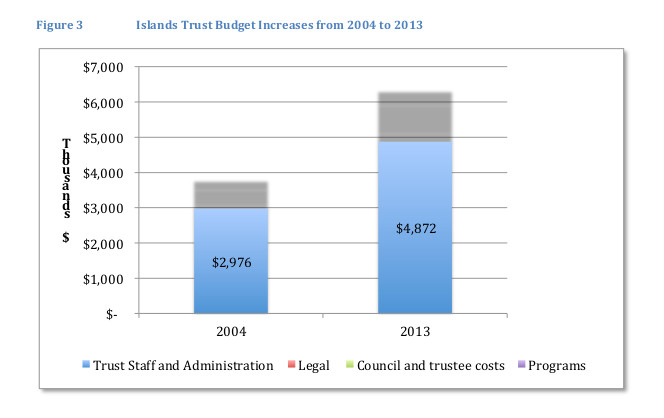

As shown in Figure 3, between 2004 and 2013, Trust staff and administration that

includes all staff in Victoria, Salt Spring and Gabriola increased by $1.9 million (64%) to

$4.9 million annually. Drilling into the numbers shows that salaries and benefits alone

increased by 65%, a combination of inflation (11%), number of staff (+40%)2 and salary

increases over and above inflation (+10%)3.

Legal costs almost doubled and program costs went up 60%.

Trustee costs also almost doubled - from $440,000 to $801,000, primarily driven by

higher remuneration. In 2010, Trust Council voted in favour of a 65% increase in the

overall remuneration for trustees to take effect in 2012. The increases differed widely

among the islands. For example, Saturna’s increase was 33%, or about $2,500 per year

(to about $10,000 which includes taxable benefits). Salt Spring increased by 132% to

$30,000 per trustee, Gabriola by 83% to $18,600 per trustee and North Pender by 64%

2

Islands Trust does not provide detailed data on number of staff. These estimates have been derived from various sources.

3

Ibid.

aturna Island Property Owners Association

Property Taxes 101: Part II

4

to $14,000 per trustee. Since 2004, the remuneration for the Chair of the Islands Trust

has increased by 120%, from $32,000 to almost $60,000 annually.

Trust

Fund

Costs

and

Benefits

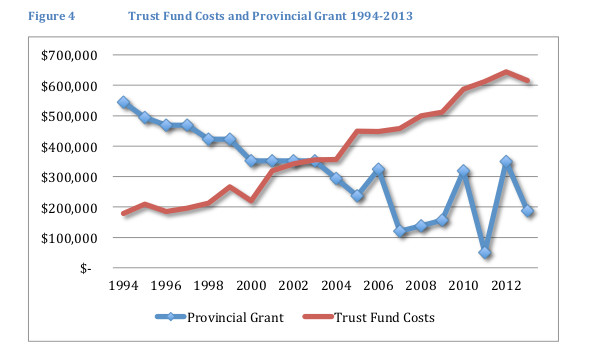

As shown in Figure 4, over the past 20 years the Province has steadily decreased its

funding of the Islands Trust while the cost of managing the Trust Fund has increased

due to having more of the Trust area covenanted “for the benefit of all British

Columbians”. With more land covenanted, the tax base in the Trust Area is reduced

(because land that is covenanted pays lower taxes) and non-covenanted properties will

bear a larger share of the tax burden. With several land conservancy agencies active to

protect land it begs the question why we have a tax-funded, local land use planning

body like the Islands Trust operating, and funding, a land conservancy whose purpose

is to benefit all British Columbians?

Conclusion

When it comes to taxes it is hard, if not impossible, to determine whether one receives

sufficient “value for money”. It is very subjective, where one person may feel it is

wasted money, others feel it is money well spent. But it is clear, even with the limited

data available, that the Islands Trust is far from cost effective.

Any organization, whose costs climb at a rate six times inflation with no expansion of

service and no discernable improvement in the quality of services, is clearly not cost

effective, nor is it well managed. The Islands Trust displays a profound lack of

accountability towards the taxpayer, which is further exacerbated by the fact that while

other public agencies have had to find efficiencies and increase productivity, the

Islands Trust has become more inefficient and less productive.

It is also questionable, in light of reduced provincial funding, whether the Islands Trust

should be managing the Trust Fund thereby having local taxpayers foot the bill for

something that is of benefit to entire British Columbia.